Summary of the Senate Democrat Spending and Tax Hike Agreement

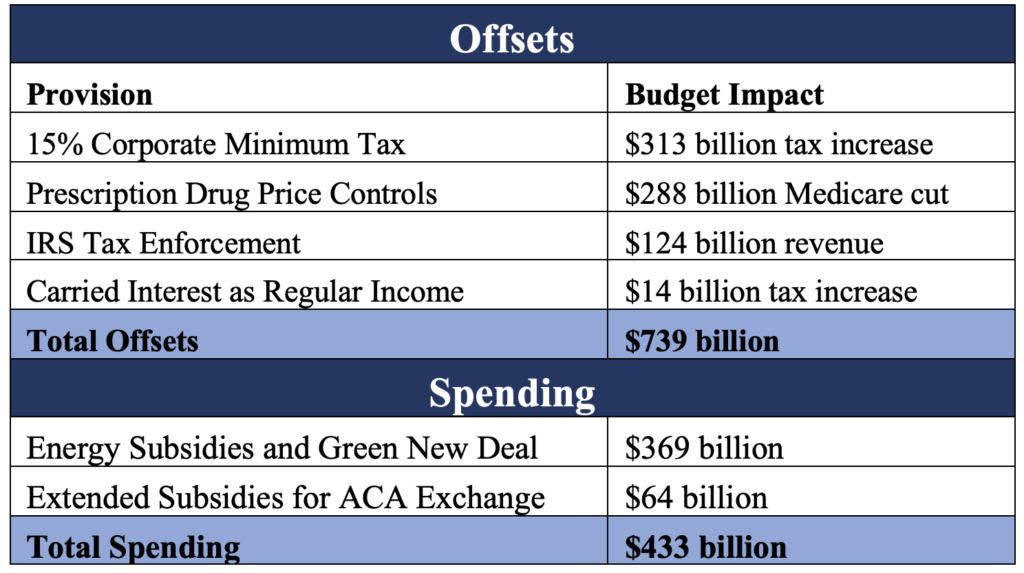

Senate Democrats have agreed in principle to a reconciliation package that includes $433 billion in new federal spending and $739 billion in offsets. Total tax increases in the proposed bill total $451 billion.

According to Senate Democrats, the main provisions of the bill would score as follows:

Taxes: The bill requires U.S. companies to unilaterally submit to a $313 billion, global 15% minimum tax that no other countries have approved. The deal also includes $80 billion to fund 87,000 new IRS agents, increase the number of IRS audits and extract $200 billion in new revenue from American workers and businesses. Finally, the bill increases taxes on domestic investment by treating carried interest as regular income.

Spending: The deal contains $370 billion in spending on nebulous green energy programs that would vastly expand government agencies while doing nothing to address our nation’s current energy crisis. Spending includes at least $75 billion in benefits directly to green energy companies, $50 billion in grants to states to conduct open-ended clean energy projects and over $40 billion in Solyndra-style loan guarantees. Potentially worse, the bill includes new fees and regulations in order to impede domestic extraction of oil, gas or coal and further exacerbate our own energy crunch.

Federal Expenditures on New and Existing Clean Energy Programs

Below are some of the largest green energy spending programs contained in the reconciliation agreement. The bill also includes hundreds of billions in tax credits and incentives. The Joint Committee on Taxation (JCT) is expected to provide an estimate of those tax cost within 72 hours.

- $60 billion to fund “environmental justice priorities” including, block grants to electrify disadvantaged communities, clean transportation grants, grants to reduce pollution at airports and zero-emission technology grants for low-income communities.

- $30 billion in grants for states and utilities to transition to “clean electricity.”

- $27 billion for a clean energy technology accelerator (“green bank”).

- $20 billion in loan guarantees for auto companies to build electric car manufacturing.

- $20 billion earmarked for farmers to transition to “climate-smart agriculture practices.”

- $10 billion investment tax credit to build clean technology manufacturing facilities,

- $9 billion in home energy rebates for retrofitting homes with electric technology.

- $9 billion for federal procurement of “clean energy technologies” including $3 billion for electric Postal Service vehicles.

- $5 billion to support forest conservation.

- $4.75 billion in grants to states to develop clean air/pollution reduction plans.

- $2 billion in grants for private car companies to retool manufacturing facilities for electric cars.

Subsidies and Tax Credits

When available, the estimated effect of a given tax credit is included below. These values are based on JCT’s November 2021 estimate of the House-passed version of Build Back Better (H.R. 5376).

- $4,000 consumer tax credit for lower/middle income individuals to buy used clean vehicles, and up to $7,500 tax credit to buy new clean vehicles (JCT score not yet available).

- Clean electricity investment credit valued at $37.2 billion according to JCT.

- Zero-emission nuclear power production tax credit equal to 0.3 cents per kilowatt hour. Valued at $22.9 billion according to JCT.

- Clean fuel production credit (Section 45Z) valued at $9.7 billion according to JCT.

- Clean hydrogen production credit valued at $9.1 billion according to JCT.

- Clean electricity production credit valued at $6 billion according to JCT.

- Ten years of consumer tax credits to make homes energy efficient by “making heat pumps, rooftop solar, electric HVAC and water heaters more affordable,” valued at $2.7 billion.

- Extension of carbon oxide sequester credit valued at $2.1 billion according to JCT.

Energy Production Fees

- Waste emissions fees for facilities that produce 25,000 metric tons of carbon dioxide each year. The fees are $900 in 2024, $1,200 in 2025 and $1,500 in 2026 and beyond.

- Methane fee on metric tons emitted from natural gas and oil production facilities that exceed 1) 20% of the natural gas sent to sale or 2) ten metric tons of methane per million barrels of oil sent to sale. The penalty is the same as the waste emissions fees (section 60113).

- Applies oil and gas royalties to extracted methane that is vented or flared.

- Permanently extends the per ton coal mine operator’s tax.

Key Concerns with the Democrats New Deal

Raising Taxes During a Recession: On Thursday we learned that the U.S. economy has contracted for two consecutive quarters. Why would anyone want to foist $450 billion in new taxes on the American people while workers struggle back from COVID and now face a recession?

Taxing American Energy: As hard-working Americans face an energy inflation crisis, Biden and Democrats are making it worse by increasing fees on domestic oil, natural gas and coal extraction.

Exacerbating the Inflation Crisis: Tax hikes in the bill will fuel $370 billion in unnecessary, Green New Deal spending on programs like “environmental justice” and “climate-smart agriculture.” Non-partisan analysis from a new Penn-Wharton study find that the bill would increase inflation for the next two years.

Handouts to the Rich: The bill includes a huge expansion of benefits that are primarily used by upper-income Americans. The electric vehicle tax credit, for instance, benefits Americans with an average income of $145,000. In states like West Virginia for instance, less than 10% have electric vehicles.

Made in America Tax: The bill would require U.S. companies to unilaterally submit to a worldwide 15% minimum tax even though no other countries have passed the same law yet.

IRS Audit Explosion: The bill includes $80 billion to increase the size and power of the Internal Revenue Service (IRS). This money will fund 87,000 new IRS agents to come after American workers and businesses with intrusive audits when we should be simplifying our tax code.

Taxes on Middle-Income Americans: Because these agents would target middle-income Americans indiscriminately and business taxes also impact individuals, this bill will undoubtedly hit Americans making below $400,000 and violate President Biden’s dubious pledge.

Medicare Cuts: In order to help pay for wasteful new spending programs, the bill includes Medicare price controls that will reduce spending on seniors’ health care by $288 billion.